A modern loan origination experience.

Meet your customers where they are and on the channels they prefer with Valeyo Ori™, a digital-first loan origination platform.

Technology-forward and built for Canadian lenders, Valeyo Ori delivers unrivalled flexibility and choice over the borrower experience, and the ability to scale your lending operations with speed and efficiency.

Read on and download a free copy of our playbook, for trends and insights on what it takes to go digital.

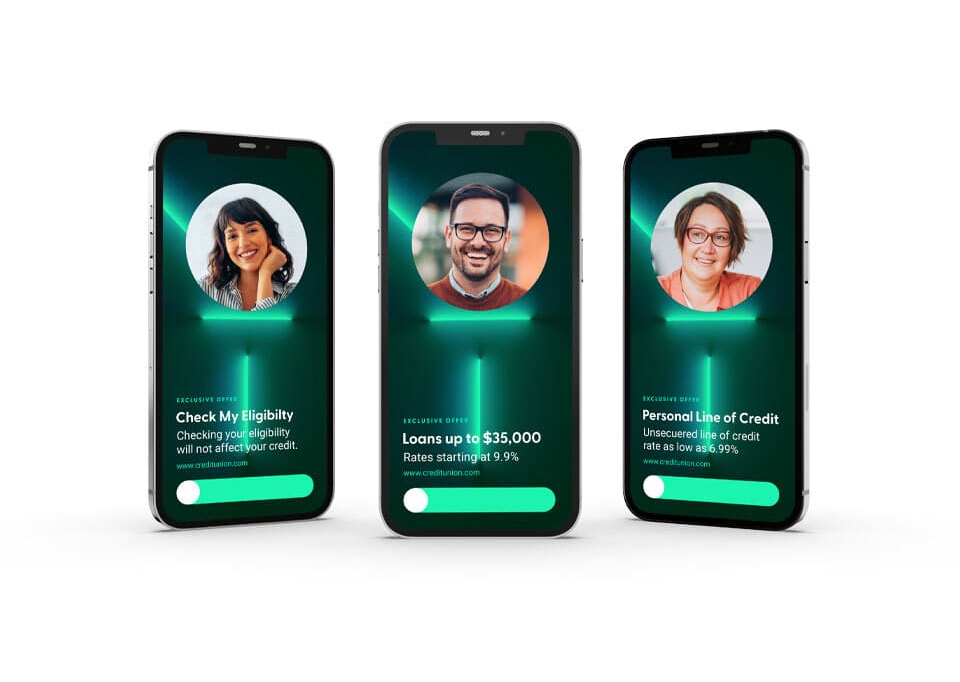

Stronger user experiences.

An intuitive, modern and configurable interface unifies brand consistency across all touchpoints, ensuring a holistic and ultimately better loan origination experience for your lenders and customers.

The depth of Valeyo Ori’s automations, workflows and integrations, frees your institution to deliver a fast, seamless and secure lending experience in-branch and online.

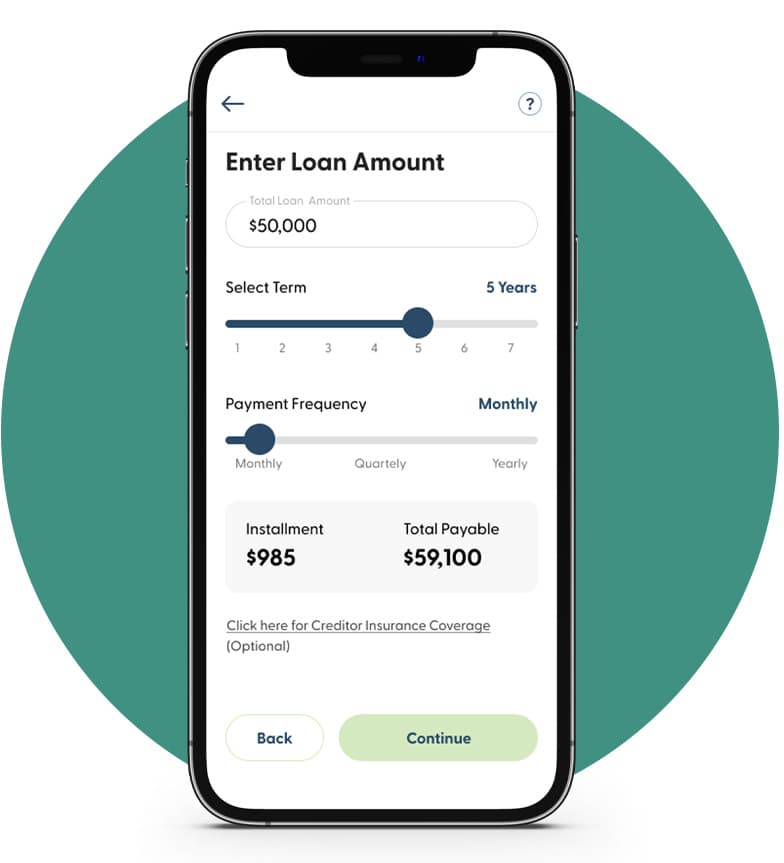

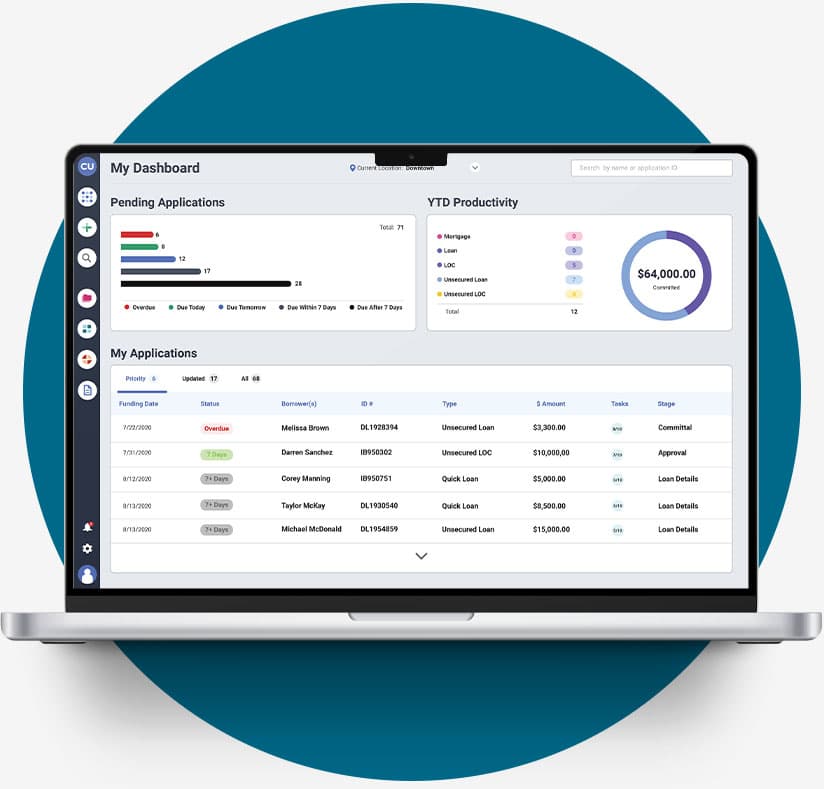

Faster lending decisions.

Valeyo Ori’s rich features and functionalities automate and optimize the lending journey. The built-in decision engine is fully customizable to your needs and risk appetite for faster, more consistent lending decisions.

With less time needed to manually approve loans, lenders can spend more time on advisory services, ultimately increasing your business capabilities and solidifying a healthy bottom line.

A greater focus on choice.

Digital lending offers more than just a paperless process. It opens new opportunities for customer acquisition and growth outside brick-and-mortar branches while strengthening overall brand loyalty.

Vendor agnostic and built on a secure API model, Valeyo Ori connects your institution to a trusted ecosystem of technology and service providers, bringing real value to your loan origination workflow.

Contact Us

Speak with our team about the Valeyo Ori platform and how it can support your financial institution’s digital lending strategy.

Simply fill out the brief form here and we’ll get back to you to schedule a call.